Solar electric 6.5kw expanded to 12.3kw

- Thread starter jebatty

- Start date

-

Active since 1995, Hearth.com is THE place on the internet for free information and advice about wood stoves, pellet stoves and other energy saving equipment.

We strive to provide opinions, articles, discussions and history related to Hearth Products and in a more general sense, energy issues.

We promote the EFFICIENT, RESPONSIBLE, CLEAN and SAFE use of all fuels, whether renewable or fossil.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

CombatChris

Member

How much better could either of these awesome setups preform with a sun-tracking setup where the panels move throughout the day? I know they're expensive as hell though...

JP11

Minister of Fire

I'm going to try manual tracking for the pole mount this year. Will be turning it SW this week to reduce midday clipping and extend solar gain period.

begreen or anyone: is it possible to edit the title from what this thread now is to something like "

Solar Electric - 6.5 kw system Expanded to 12.3 kw "?

Solar Electric - 6.5 kw system Expanded to 12.3 kw "?

Last edited by a moderator:

JP11

Minister of Fire

JP, that's what you've been waiting for and more to come. What a great day you had!

Mirror image today. within 500 watts of yesterday. Sun is melting all the snowpack though. I've got a moat across my driveway. Culverts are frozen up.

And we had practically no snow all winter, temps have been in the 60's, ice went out on the lake on April 11, two days later than the early ice-out record that anyone can remember, no rain yet this spring, nearby wetlands are nearly dry, and red flag forest/grass fire conditions.

Thanks for the title change.

In 2007 I bought and self-installed the Tarm Solo Plus 40 wood gasification boiler, and still today I remain amazed at the energy and efficiency in a well designed hydronic heating system using a gasifer. The energy in wood (a solid form of stored solar energy which is sustainable) is immense, using wood for space heating has saved us a lot of money, and our household is nearly completely free of fossil fuel sourced space heating (backup up only for electric heat and emergency on-electric LP space heater).

Then in October 2013 I had installed a 6.5kw solar PV system (26 - 265w panels), and my amazement multiplied. I still view in awe energy being generated, and lots of it, from doing nothing. The panels just sit there and make electricity. Being a ground mount, I am able to and do clear snow from the panels during the winter, so not quite do nothing. The effort is very minimal.

When the 6.5 kw system was installed I had over-sized underground cabling installed which would have the capacity to handle the maximum power I could backfeed into the grid. And very glad that I did this. The 6.5 kw system performed so well that in early April 2015 I had installed another 5.4kw of PV (20 - 270w panels) to max the system. The posts on pages 11 and following detail some of the experience so far. More info will follow.

In 2007 I bought and self-installed the Tarm Solo Plus 40 wood gasification boiler, and still today I remain amazed at the energy and efficiency in a well designed hydronic heating system using a gasifer. The energy in wood (a solid form of stored solar energy which is sustainable) is immense, using wood for space heating has saved us a lot of money, and our household is nearly completely free of fossil fuel sourced space heating (backup up only for electric heat and emergency on-electric LP space heater).

Then in October 2013 I had installed a 6.5kw solar PV system (26 - 265w panels), and my amazement multiplied. I still view in awe energy being generated, and lots of it, from doing nothing. The panels just sit there and make electricity. Being a ground mount, I am able to and do clear snow from the panels during the winter, so not quite do nothing. The effort is very minimal.

When the 6.5 kw system was installed I had over-sized underground cabling installed which would have the capacity to handle the maximum power I could backfeed into the grid. And very glad that I did this. The 6.5 kw system performed so well that in early April 2015 I had installed another 5.4kw of PV (20 - 270w panels) to max the system. The posts on pages 11 and following detail some of the experience so far. More info will follow.

A few quick reasons why I was motivated to install PV:

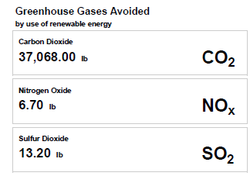

1) To do the "right thing." The results to date:

2) Simple rate of return (current annual $ value of electricity produced / cost of system) was 4.5-5%.

3) Had cash available that was earning much less than simple rate of return.

4) Retired and PV was a way to eliminate/reduce a monthly expense and hedge against rising electric rates.

1) To do the "right thing." The results to date:

2) Simple rate of return (current annual $ value of electricity produced / cost of system) was 4.5-5%.

3) Had cash available that was earning much less than simple rate of return.

4) Retired and PV was a way to eliminate/reduce a monthly expense and hedge against rising electric rates.

Last edited by a moderator:

What is the payback on PV? Much discussed, but here's my summary take on this topic. Payback depends on lots of variable and projections into the future; therefore, lots of assumptions. This pun is intended: not easy to see through the clouds to predict the future, but a future where renewable energy of various sorts likely will play an increasingly larger role in electricity generation. History is far more certain.

My initial 6.5kw system (now re-rated to 6.89kw) produced 9MW of electricity in year one. At my local kwh utility rate, that had a value of $1,035. The system was designed by a consultant and installed by a local electrician. The only work I did was setting up the controller for the panel microinverters. In round numbers the cost of the system was $32,000, and after the federal tax credit (no other incentives/rebates available) the cost was $22,400. Cost per watt of rating was $4.64 of total cost and $3.25 of net cost. My system was more expensive than most due to ground mounts and location a little more than 200 feet from the meter connection with required underground wiring, including boring under a public road.

The return on investment in Year One was 3.2% on the total cost and 4.6% on the net cost. Year One maintenance/repair cost was $0. The only effort I expended was clearing snow off the panels, about 10 minutes per snow event.

Is "payback" the right question to ask? In my perspective, it might be but also might not be. PV does return real dollars every year. It's projected lifespan is 25+ years, future maintenance/replacement of microinverters is possible, and in place systems have been in operation longer than 25 years. It is highly probable that PV will ultimately pay for itself and provide a return in excess of investment. Therefore, PV is not an item of consumption but is a real investment. My calculation based on various assumptions is that economic payback will occur somewhere in the period of Years 17-19.

The dollars paid for the PV could have been invested in CD's, at around 1% rate of return, in the stock market with a very good return in 2014 but in another year could have produced a large loss, or in a variety of other "investments" that provide an economic return: education, for example.

Or, the dollars could have been used to fuel consumption: a new car or truck, a fancy vacation, the local casino, and the list continues. None of these would have produced an economic return, each would have been a depreciating "asset" or fully consumed in a year, and most would have involved additional costs to be able to use the "asset." In other words, the consumption route ends up with nothing left over except perhaps the enjoyment which comes from spending the money, which is not a bad outcome.

Which is the better outcome? Personal preferences rule here. For me, a financial conservative, retired and on fixed income, spending this money to reduce future expenses and not spending the money on unnecessary consumption ruled the day. My system likely will eliminate my electric bill for the rest of my life -- that has real value.

My initial 6.5kw system (now re-rated to 6.89kw) produced 9MW of electricity in year one. At my local kwh utility rate, that had a value of $1,035. The system was designed by a consultant and installed by a local electrician. The only work I did was setting up the controller for the panel microinverters. In round numbers the cost of the system was $32,000, and after the federal tax credit (no other incentives/rebates available) the cost was $22,400. Cost per watt of rating was $4.64 of total cost and $3.25 of net cost. My system was more expensive than most due to ground mounts and location a little more than 200 feet from the meter connection with required underground wiring, including boring under a public road.

The return on investment in Year One was 3.2% on the total cost and 4.6% on the net cost. Year One maintenance/repair cost was $0. The only effort I expended was clearing snow off the panels, about 10 minutes per snow event.

Is "payback" the right question to ask? In my perspective, it might be but also might not be. PV does return real dollars every year. It's projected lifespan is 25+ years, future maintenance/replacement of microinverters is possible, and in place systems have been in operation longer than 25 years. It is highly probable that PV will ultimately pay for itself and provide a return in excess of investment. Therefore, PV is not an item of consumption but is a real investment. My calculation based on various assumptions is that economic payback will occur somewhere in the period of Years 17-19.

The dollars paid for the PV could have been invested in CD's, at around 1% rate of return, in the stock market with a very good return in 2014 but in another year could have produced a large loss, or in a variety of other "investments" that provide an economic return: education, for example.

Or, the dollars could have been used to fuel consumption: a new car or truck, a fancy vacation, the local casino, and the list continues. None of these would have produced an economic return, each would have been a depreciating "asset" or fully consumed in a year, and most would have involved additional costs to be able to use the "asset." In other words, the consumption route ends up with nothing left over except perhaps the enjoyment which comes from spending the money, which is not a bad outcome.

Which is the better outcome? Personal preferences rule here. For me, a financial conservative, retired and on fixed income, spending this money to reduce future expenses and not spending the money on unnecessary consumption ruled the day. My system likely will eliminate my electric bill for the rest of my life -- that has real value.

Cost of install for the 5.4kw addition: $23,782, or $4.40/watt before the federal tax credit, $16,647 after the federal tax credit, or $3.08/watt. If the addition produces electricity at the same rate as the initial system, then the additional 5.4kw array will produce 7054 kwh of electricity valued at $811, and the simple rate of return will be 4.9% on the net cost.

You know I think PV is a better investment than a CD at 1%, and while the expected return is less than the market, the risk is lower, which makes it a sensible personal choice.

But, if the array has a lifetime of 25 years, then it has zero value at 25 years, and its depreciation must be included in a ROI calculation to compare to those other investment instruments. You will not get your principal back. On a linear depreciation schedule, depreciation costs you 4% per year, and your simple return is 1%, at least for the first 25 years.

IOW, after 25 years at current cash flow, you will have a pile of money a bit larger than your net cost, say (25*5%) = 125% of initial net investment, and a nominally zero-value array. With the 1% CD, you will get 100% of your principal back + about 30% compounded gains.

I'd call it an inflation or energy inflation hedge. Or a hobby.

But, if the array has a lifetime of 25 years, then it has zero value at 25 years, and its depreciation must be included in a ROI calculation to compare to those other investment instruments. You will not get your principal back. On a linear depreciation schedule, depreciation costs you 4% per year, and your simple return is 1%, at least for the first 25 years.

IOW, after 25 years at current cash flow, you will have a pile of money a bit larger than your net cost, say (25*5%) = 125% of initial net investment, and a nominally zero-value array. With the 1% CD, you will get 100% of your principal back + about 30% compounded gains.

I'd call it an inflation or energy inflation hedge. Or a hobby.

Last edited:

Actual longevity likely is far more than 25 years. The Suniva panels carry a 25 year warranty.

The 1% CD loses money every year due to inflation and taxes, has declining net present value, and there is no gain.

Year One for CD at 1%: $22,400 x .01 = $240. Total value = $22,640. Combined federal and state income taxes on $240 at assumed 25% rate = $60. Net total value = $22,580. Discount at assumed average 3.5% inflation rate = $22,580 x 0.965 = $21,789.70 net present value at end of Year One.

Year One for PV: $1,035 real value returned through payment of electric utility bill. Amount of money in a 1% CD that would pay $1,035 (ignore tax on the interest) = $103,500. I submit that the $22,400 PV system has a value much greater than the price I paid because it produces a much higher rate of return than a CD investment. But assuming that the PV system only added $22,400 to the value of my house, after inflation that would be worth $21,616 + $1,035 returned through payment of electric charges = $22,651 at the end of year one, $861 greater than the CD investment.

The 1% CD loses money every year due to inflation and taxes, has declining net present value, and there is no gain.

Year One for CD at 1%: $22,400 x .01 = $240. Total value = $22,640. Combined federal and state income taxes on $240 at assumed 25% rate = $60. Net total value = $22,580. Discount at assumed average 3.5% inflation rate = $22,580 x 0.965 = $21,789.70 net present value at end of Year One.

Year One for PV: $1,035 real value returned through payment of electric utility bill. Amount of money in a 1% CD that would pay $1,035 (ignore tax on the interest) = $103,500. I submit that the $22,400 PV system has a value much greater than the price I paid because it produces a much higher rate of return than a CD investment. But assuming that the PV system only added $22,400 to the value of my house, after inflation that would be worth $21,616 + $1,035 returned through payment of electric charges = $22,651 at the end of year one, $861 greater than the CD investment.

JP11

Minister of Fire

Wow, you're costs were really up there. I was just under 35 for my 12kw roof mount. very little wire to get down off the roof to inverter, and barn supply where it ties in. Prior to 10+ back on federal grant.

I think the bigger 'unknown' is the net metering laws. It has, and will continue to be a battle. The laws could change our ROI in a huge way. They go more green and we could be getting paid better than market rate. They start paying us wholesale during the day, and we buy back retail at night.. that's gonna hurt!

With the system paid for.... I just feel like all i've done is get rid of my power bill. That's pretty cool in and of itself. However.. it will be another 9 years or so before I'm truly in 'the black'

JP

I think the bigger 'unknown' is the net metering laws. It has, and will continue to be a battle. The laws could change our ROI in a huge way. They go more green and we could be getting paid better than market rate. They start paying us wholesale during the day, and we buy back retail at night.. that's gonna hurt!

With the system paid for.... I just feel like all i've done is get rid of my power bill. That's pretty cool in and of itself. However.. it will be another 9 years or so before I'm truly in 'the black'

JP

Actual longevity likely is far more than 25 years. The Suniva panels carry a 25 year warranty.

The 1% CD loses money every year due to inflation and taxes, has declining net present value, and there is no gain.

Year One for CD at 1%: $22,400 x .01 = $240. Total value = $22,640. Combined federal and state income taxes on $240 at assumed 25% rate = $60. Net total value = $22,580. Discount at assumed average 3.5% inflation rate = $22,580 x 0.965 = $21,789.70 net present value at end of Year One.

Year One for PV: $1,035 real value returned through payment of electric utility bill. Amount of money in a 1% CD that would pay $1,035 (ignore tax on the interest) = $103,500. I submit that the $22,400 PV system has a value much greater than the price I paid because it produces a much higher rate of return than a CD investment. But assuming that the PV system only added $22,400 to the value of my house, after inflation that would be worth $21,616 + $1,035 returned through payment of electric charges = $22,651 at the end of year one, $861 greater than the CD investment.

I don't feel like trolling your thread (again

). But inflation is 2%, CDs that pay 1% don't have a 25 year term (giving you flexibility in the future). Just that it is disengenuous to keep citing a 5% risk free return when you neglect both (1) maintenance and depreciation and (2) risk that funding for net metering might change in the future.

). But inflation is 2%, CDs that pay 1% don't have a 25 year term (giving you flexibility in the future). Just that it is disengenuous to keep citing a 5% risk free return when you neglect both (1) maintenance and depreciation and (2) risk that funding for net metering might change in the future.

Last edited:

We agree far more than we where we have differences of opinion. My example was for Year One because that's where we are right now. In my prior thread Payback, I set forth the assumptions on which the 5% rate of return was based over the long term. Depreciation certainly is a factor. I did include a 0.5% derate per year. PV systems have been installed for far more than 25 years. Your guess is as good as mine on what a depreciation period should be. I won't live to see the first 25 years end. As to maintenance, it will be wait and see. After 1-1/2 years there has been none and no indication of when or what maintenance may be needed. The microinverters are warranted for 10 years, Wiring may be impacted over time, but all of the wiring is behind the panels, generally free from sun and most weather caused degradation. My racking is commercial grade, very heavy duty. If you have maintenance info on other high quality systems, I would be interested in seeing that.I don't feel like trolling your thread (again)....

There certainly are risks. I just see currently that the risks are very minimal, probably much less than the myriad of other risks we face on this planet Earth.

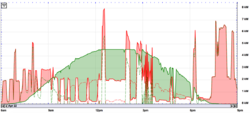

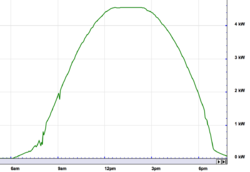

Earth Day 2015, April 22, made history with my 12.3kw PV system. How appropriate. Production hit 88.93 kwh, and that included a few morning clouds. Peak production was 11,839 watts. When I run the ratios, April 22 out-performed the best comparative performance for my system before expansion. I did not see any clipping of the panels. The best day ever (March 15, 2014) for the 6.95kw array was 48 kwh. That means an equivalent best performance for the 5.4kw array should have been 37kw, for a total of 85 kwh. The clear sky forecast for today has the potential of doing as well, or maybe better?

Last edited by a moderator:

JP11

Minister of Fire

Last edited:

April 2015 likely will rank as one of the best PV months: 1.57MWh of production (actual was about 30kwh higher due to a data logger malfunction which did not record full production on one day). The 5.4kw addition went active late afternoon on April 9, so beginning with April 10 daily production included the 5.4kw addition.

Last edited:

May 19 tied my record for kwh daily production: 89kwh. Maximum output was 11,394 watts. What I haven't seen this year compared to last year, although I haven't been watching momentary output very much, is panel output above 265W/panel. April 22 also produced 89kwh, with maximum output at 11,839 watts.

JP11

Minister of Fire

Nice. My peak so far is 85.2 Days are still getting longer though. I imagine the few kw difference between us is just my clipping at 10.8kw from the inverters.

JP

JP

Similar threads

- Replies

- 8

- Views

- 2K

- Replies

- 11

- Views

- 2K