I'm looking at these low PV prices - definitely tempting!

So, before I make all the mistakes everyone else is/has, can folks clue me in on some things?

1. My roof is about 210 degrees facing - just about SW exactly - and is 12/12 - 45 degrees. Am I just as well, in MA, installing directly on it? I need to roof mount due to high tree line.

2. These very low prices of $1 or so a watt - based on all available evidence, is this an anomaly or is the combo of excess capacity and new R&D likely to make prices stay low in the future?

3. Any Ma-certified installers out there who want to bid on something for me? Or, are there any co-ops or other group efforts in Western Ma or vicinity?

4. Given a budget of 6-10K out of pocket - after Federal and (if any) state credits, what size system should I be looking at? I may be limited by full sun roof space - I definitely have 250 sq feet or so.....so that may not be a limit?

5. One of my big interests is in a back-up when power fails, so I would want a small battery bank in addition to any (if any) grid tie. I may even be satisfied with no grid tie at all - that is, a smaller system which perhaps feeds a couple circuits that are always used (refrig, etc.).....and a backup circuit.....for power out (I can plug stuff into an inverter - I'm pretty handy with stuff)....

It's all so confusing. I'm thinking that sometimes it doesn't pay to go big - we don't have kids around the house so keep all the lights off, etc.....and are gone a lot of the time also, so maybe appropriate technology (smaller) is better? At the same time, if the larger system is free due to more tax credits - well, call me a welfare king!

Opinions?

So, before I make all the mistakes everyone else is/has, can folks clue me in on some things?

1. My roof is about 210 degrees facing - just about SW exactly - and is 12/12 - 45 degrees. Am I just as well, in MA, installing directly on it? I need to roof mount due to high tree line.

2. These very low prices of $1 or so a watt - based on all available evidence, is this an anomaly or is the combo of excess capacity and new R&D likely to make prices stay low in the future?

3. Any Ma-certified installers out there who want to bid on something for me? Or, are there any co-ops or other group efforts in Western Ma or vicinity?

4. Given a budget of 6-10K out of pocket - after Federal and (if any) state credits, what size system should I be looking at? I may be limited by full sun roof space - I definitely have 250 sq feet or so.....so that may not be a limit?

5. One of my big interests is in a back-up when power fails, so I would want a small battery bank in addition to any (if any) grid tie. I may even be satisfied with no grid tie at all - that is, a smaller system which perhaps feeds a couple circuits that are always used (refrig, etc.).....and a backup circuit.....for power out (I can plug stuff into an inverter - I'm pretty handy with stuff)....

It's all so confusing. I'm thinking that sometimes it doesn't pay to go big - we don't have kids around the house so keep all the lights off, etc.....and are gone a lot of the time also, so maybe appropriate technology (smaller) is better? At the same time, if the larger system is free due to more tax credits - well, call me a welfare king!

Opinions?

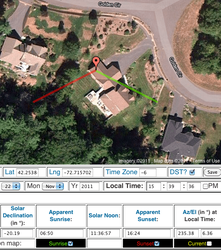

-- its fairly simple to go through and use, and most people end up with a better understanding of the path of the sun in relation to the house.

-- its fairly simple to go through and use, and most people end up with a better understanding of the path of the sun in relation to the house.