I would opt out of social security right now at 38 yrs old..as I know I will never see a penny of my hundreds of thousands over a lifetime.

A common argument I have with republican friends is that they believe SS is a savings account held in their name that the feds are stealing. That's not how it works. SS is a tax funded old age insurance policy that pays out like an inflation adjusted fixed annuity. It is not a savings vehicle.

Im 40. And have been paying into SS at the cap rate for years. If you pay in at the cap from the day you turn 20 till the day you hit 65 you would pay an inflation adjusted 300k give or take over 45 years give or take. But most people pay far less, and the formula allows you to draw the full benefit after only 35 years of paying in. Anyone who lives past their mid-80s draws out more than they paid in.

Unless the world ends or you die before your FRA you WILL get something. The current estimate is that the program will stop running surpluses in about 4 years, and then will draw down the trust funds till they are exhausted in 2034, after which SS will only be able to pay out from FICA tax receipts which is projected to cover 70ish % of expected obligations.

Medicare funding is a bigger problem, but so many Americans rely on both programs that at some point the parties will be force to compromise on a fix (increased taxes and/or benefit cuts). They have done it before, as seen when congress approved making benefits taxable during the Reagan years.

http://www.cbpp.org/research/social...understanding-the-social-security-trust-funds

I would give up paying for obamacare.

Liberals dont like Obamacare either. We wanted universal single payer, but what we got was ACA, otherwise known as Romneycare which was modeled after an idea (albeit not popular) that some conservative think tank came up with in the 90s

http://www.politifact.com/punditfac...5/ellen-qualls/aca-gop-health-care-plan-1993/

The reality is there is no easy fix.

Moving to universal single payer is probably a non starter because the private insurance industry would implode and destroy the economy. (To bad since single payer is proven to be a workable system that provides care at a fraction of the price we pay all over the first world)

Going back to the old purely private system will leave lots of people without insurance. That doesn't actually save us any money - because all those uninsured go to the ER when they get sick and get care but cant pay the bill. The cost of that care is baked into the rates that those of us with insurance pay. So we will pay either way. This way is more expensive.

I would give up public schools or take a tax different to spend my money on private schools.

Abolish public schools? Are you serious? Send us right back to the middle ages where only the lords can afford to give their kids an education while the rest of us peasants labor in the fields. No thanks.

I would keep the troops home, since our excessive military spend is overseas in wars that make us less safe not more safe. I'd the take the military surplus and secure our border.

On this we agree. We are all tired of all the wars.

I would elimate the TSA as they do not make us safer.

I haven't researched enough to comment intelligently on this one... but there does appear to be problems....

There is no limit to how much the government can spend and tax. Evidence enough is our $18T debt that we can only afford the interest payments on..and has been doubling every 4-5 yrs.

Ok this one is complicated and I dont understand it all./ There used to be a fellow on this board (Ashful remembers

) who would come on here

and give us a 5 page economics treatise about how the debt is meaningless since we print the money and can just inflate it away.

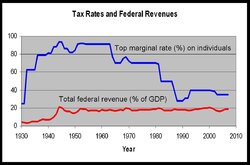

What I do know is that looking at it in absolute dollars is a less informative picture that looking at it in inflation adjusted terms or better yet as a % of GDP. As a % of GDP it looks like this:

Now you can see clearly that it spikes whenever we have to spend our way out of a crisis -WWI, WWII, the depression, the great recession. You can also clearly see how it went up during the free spending Reagan years, down during the clinton surpluses and spiked hwen GWB signed the great recession bailout package.

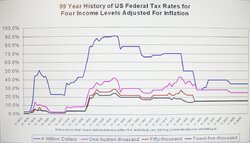

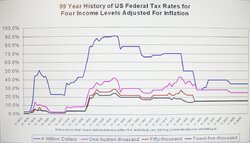

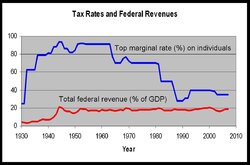

Meanwhile tax rates have been on a continual trend down since the 60s, with the highest earners getting the most relief

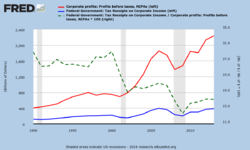

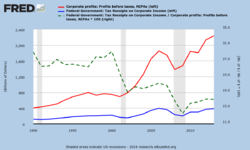

And corporations too:

Agree completely on NAFTA and bailouts.

Actually taxes hurt the little guy disproportionately more than the wealthy. Gas taxes, sales taxes, home taxes and the like are a straight percentage of total purchase price..and a greater percentage of a little guys total wage.

Tax rates a re very different than taxes collected. If you look from a very high level, tax collected as % of GDP has been about the same since the 50's. What has changed is all of the fines that are new since the 50's and always keep increasing..and state taxes not in federal income tax rates.

We agree that taxes hit the little guy worse - which is why liberals rail against tax cut plans that provide more relief to the highest incomes than to the middle and working classes.

jebatty already pointed out that gas taxes have been flat for years. I live in a state (Mass) that's usually considered high tax but the reality is that we have been cutting taxes here for decades and actually our income and sales taxes are only average nationally . However expenses keep growing with inflation so the result of all that tax cutting is crumbling infrastructure, failing transit and spiraling debt that is starting to bite us in the @$$. Towns are forced to make up the difference in lost state revenue by hiking property taxes, but Prop 2.5 limits what they can do so instead they have to cut school programs and institute fees.

I always find it funny how people can expect to get annual 4% raises in the private sector then turn around and claim teachers, cops and firemen should accept a salary frozen for life because it comes out of taxes

) who would come on here

) who would come on here