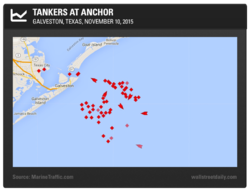

Something to think about.

http://www.fool.com/investing/gener...es-another-warning-of-a-future-oil-price.aspx

http://www.fool.com/investing/gener...es-another-warning-of-a-future-oil-price.aspx

Something to think about.

http://www.fool.com/investing/gener...es-another-warning-of-a-future-oil-price.aspx

Yep. And the OPEC meeting broke up today with no agreement to cut production. It is gonna be buy one get one free pretty soon.

So keep buying low now. I assume since its in the market, you don't need it for retirement anytime soon.Since half of what I am worth is invested in oil company stocks I am wondering the same thing.

But the bad kicker is that exploration is gonna come to a screeching halt and five to ten years from now it ain't gonna be pretty.

Just wondering how much of low oil prices aren't to keep pressures on the Russian economy. When you look at who is hurting from low oil prices they are the first to come to mind. Add in the sanctions imposed and then look at how the ruble is doing.

Crude prices in the high 30s today. Hard to believe. Iv got a lot of empty tanks since i got away from oil. About 2000 Gals worth.

Some guy here said in July that oil was gonna be cheap through the end of the year if not beyond. Wonder who that guy was.

7 year low the other day. These are some insane price

So keep buying low now. I assume since its in the market, you don't need it for retirement anytime soon.

Pls define insane....

Inflation corrected oil prices were lower than the current $37 for nearly all of the period 1985 to 2004, 19 years.

I don't see why they can't be this low or lower for a couple years. The Saudis have 4 years of money in the bank if they don't tighten their rather posh belts.

In a more distant future where global oil demand is lower and falling (some has to be left in the ground, they say), I don't see why the price couldn't be here or lower for decades.

Pls define insane....

Inflation corrected oil prices were lower than the current $37 for nearly all of the period 1985 to 2004, 19 years.

I don't see why they can't be this low or lower for a couple years. The Saudis have 4 years of money in the bank if they don't tighten their rather posh belts.

In a more distant future where global oil demand is lower and falling (some has to be left in the ground, they say), I don't see why the price couldn't be here or lower for decades.