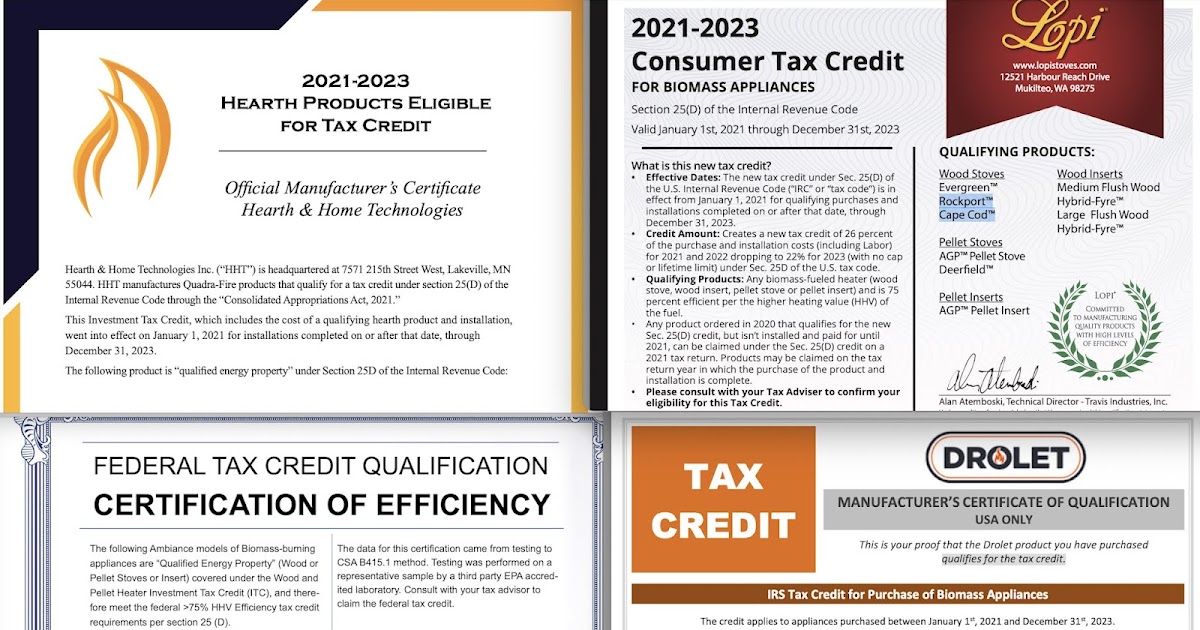

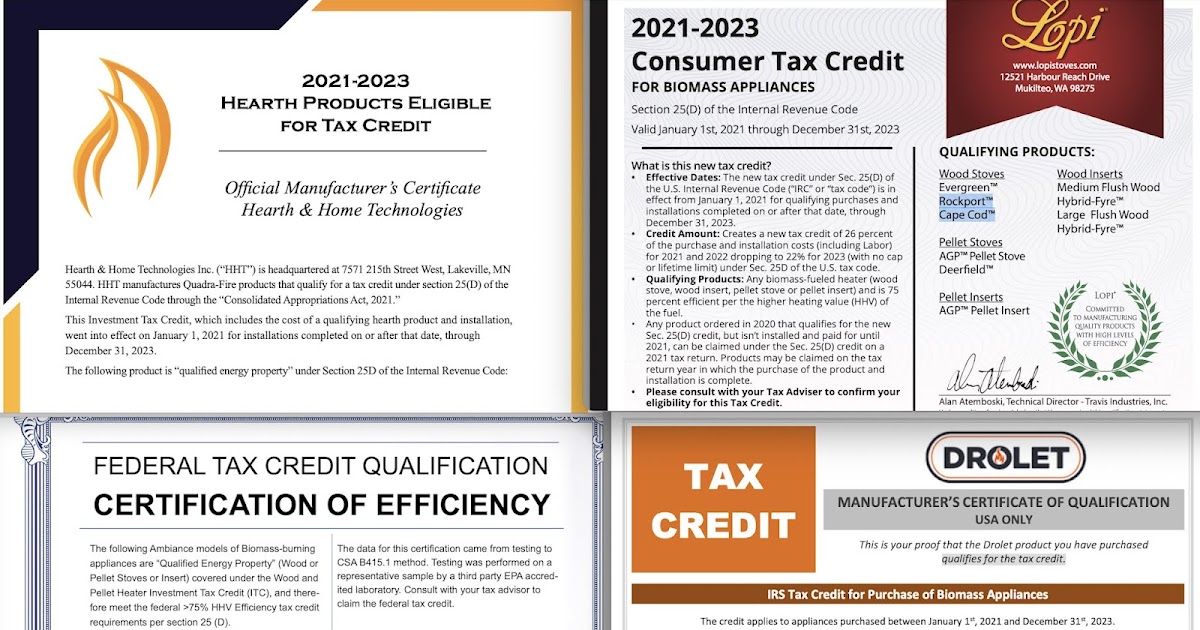

As far as we can tell, in 2021, consumers are finally getting pretty accurate info from manufacturers about efficiencies and which models qualify for the tax credit. Interested to know if others have noticed that. We only found one stove company that continues to claim stoves way down in the mid-60 efficiencies, are eligible for the tax credit. We had a good exchange with that company but they did not want us to quote them on their side of the story - (which we did not really understand or find credible). Should be a good year for stove sales - at least for brands that can keep up with demand and minimize supply chain issues. Also interested in whether you all feel the tax credit is that important and drives consumers toward higher efficiency stoves.

forgreenheat.blogspot.com

forgreenheat.blogspot.com

Consumers can now rely on almost all stove tax credit certificates issued by manufacturers

Wood stove, pellet stove, NSPS, EPA, PM, grams per hour, efficiency, LHV, HHV, cleanest, best, carbon neutral, biomass, tax credit, IRS, certified